How many times have you heard a progressive Leftist disparage supply-side economics? For example, progressives will say supply-side fiscal policies deliver nothing but tax cuts for the rich, thereby putting more wealth in the hands of the one percent. They then tell us how these policies only allow a small portion of this wealth to “trickle-down” to the middle class and the poor. Unfortunately, for progressives, this distorted view of supply-side policies can easily be refuted by both common sense and economic history. Here is a primer on what supply-side is, and is not, and why it is an essential element of creating economic prosperity for the rich, the middle class, and even the poor.

Let’s Describe Supply-Side Economics What It Really Is: Incentive Economics.

The term “supply-side” economics has gained a stigma among progressive Leftists who use the term as a political pejorative. No matter, as a more accurate way to describe supply-side economics would be to call it “incentive” economics. Supply-side policies are crafted around a credible understanding of human nature that makes predictions about how individuals will respond to the incentives created in the world around them. This includes incentives that affect their behavior, economic choices, and social decision making. Regarding fiscal policy, supply-side theory also recognizes a connection between high marginal tax rates and its detrimental effects on economic growth. However, supply-side theory incorporates a much broader set of fiscal and economic policies that progressives choose to ignore. Economist Art Laffer has noted these policies to include:

- Free and fair trade

- Stable prices (i.e. low inflation) and the sound value of money

- Efficient and effective regulation of private industry

- Welfare policies that encourage work

- Generous immigration policy that requires self-sufficiency

- Efficient (i.e. cost-effective) government

These supply-side policies, combined with a commitment to low marginal tax rates, are what its advocates see as leading to broad based prosperity for the rich, middle class, and the poor.

Empirical Evidence the Left Cannot Refute… History Tells Us Supply-Side Policies Work.

Supply-side advocates have a strong case supporting their policies based on economic history. For example, in 1935, President Franklin Roosevelt’ (FDR) launched his Second New Deal that repeatedly ignored supply-side tenets by initiating aggressive government intervention in the private sector. The Second New Deal included a series of tax-the-rich/spending initiatives that were enacted at the same time FDR launched a public relations campaign to blame the nation’s economic troubles on the wealthy. In response to FDR’s initiatives, capital effectively went “on strike” as private domestic investment plummeted between 1937 to 1938. FDR’s Second New Deal pushed America back into what is now called the famous “depression within a Depression.” This resulted in skyrocketing unemployment rates that went from about 12 percent in 1937 to more than 20 percent by 1939.

Unfortunately, FDR did not learn the economic lessons from only one decade earlier. President Calvin Coolidge demonstrated that supply-side tax cuts on the highest income earners from 77 percent to 25 percent could produce greater economic growth and higher tax revenues. This fiscal exercise of reducing federal income tax rates to increase growth and revenues has been repeated four times since Coolidge by the Kennedy, Reagan, Clinton and Trump administrations. Yet, even today, progressives will continue to ignore these lessons, preferring instead to wage class warfare.

The Goal of Supply-Side Fiscal Policy: Finding the Optimal Tax Rate.

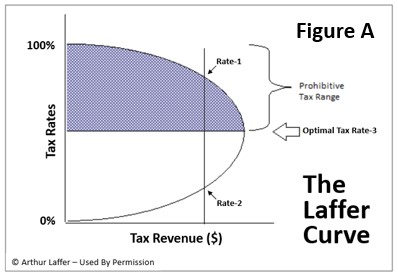

If the progressive Left would like the rich to pay more in taxes, they should consider incentivizing them to do what the rich do best: generate more taxable wealth. Historical evidence shows that reducing high-marginal tax rates on wealthy individuals can generate more tax revenue, not less, if two conditions are met. First, the tax cuts must be permanent (or very long-term) and not a one-time gimmick. Secondly, nominal tax rates must not be higher than the optimal tax rate as indicated by the Laffer Curve (see Figure A).

The Laffer Curve illustrates the real-world incentive effects of alternative tax rates on tax revenue generation. The reader should note that at one extreme of the curve, if the government sets a tax rate of zero percent on income, then no matter how much income an individual earns there is no tax revenue generated. Simple and logical enough. However, at the other extreme of the curve, if the government taxes a worker at 100 percent or more of the income they earn, then you eliminate all incentive for that worker to earn income. At a 100 percent tax rate, a rational individual would rather stay at home and do nothing or find a way to evade the government tax and work “under the table.” In either case, the resulting tax revenue to the government would still be zero. Therefore, the Laffer Curve suggests somewhere between the tax rates of zero percent and 100 percent there is an optimal tax rate that maximizes a return of tax revenue to the government while still providing an incentive for the individual to continue to work and maximize their income.

Yes Virginia… You Can Generate More Tax Revenue with Lower Tax Rates.

A critical point behind the supply-side argument is that if you advocate high marginal tax rates (note Rate-1 above), you may be overlooking the fact that there is a lower tax rate (note Rate-2 above) at which an individual (or collective workforce) will pay the same amount of tax revenue. Further, there may be a third optimal tax rate (note Rate-3 above) that would return an even higher level of tax revenue if rates were set at that point. Therefore, the goal in setting marginal tax rates should be to avoid setting them above this tipping point where one would start to see diminishing returns on taxes paid. Economic history is clear on these supply-side incentive effects, even though progressives continue to confuse tax rates and tax revenues in their class warfare arguments.

Progressive Arguments Concerning “Trickle-Down” Economics Are Meaningless and Hypocritical.

The progressive Left loves to attack supply-side economics because they do not align with their strategy of managed economies, wealth redistribution, government dependence and equal economic outcomes. They argue that tax cuts for individuals across all income brackets allows the wealthy to gain the greatest return while offering the middle class and poor merely “trickle-down” benefits. But the concept of trickle-down has no real economic meaning. Thomas Sowell once publicly challenged anyone to name an economist, regardless of their school of thought, who had ever advocated trickle-down as an economic theory. He had no takers. That is because the concept of “trickle-down” is not an economic theory, it is a political argument.

Of course, President Obama and other progressive Democrats have supported their own version of trickle-down economics to benefit their wealthy cronies. Columnist George Will once described President Obama’s version of trickle-down economics as supporting appointments to the Federal Reserve Bank who would keep interest rates near zero, thereby driving people out of bonds and into other assets, especially stocks. Will noted Obama’s policies have rewarded the 10 percent of Americans who directly own 80 percent of stocks, a fact that explains why 95 percent of wealth created during the Obama presidency went to the infamous “1 percent” of Americans that progressives frequently deride.

Here’s Another Canard That Progressives Use in Class Warfare: Income Inequality.

One last point that cannot be ignored is that when the American economy experiences a period of strong economic growth from supply-side policies, economic inequality will not shrink but rather grow. This reality does not disadvantage the poor or middle class. In fact, quite the opposite. Prosperity and economic growth will create new wealth that will eventually find its way into greater educational and training opportunities for those looking to advance economically within a growing free-market system. Progressives will ignore education as a great enabler of income mobility because it requires individual initiative and does not align with their message of victimization and government dependency. However, able-bodied individuals who are concerned about their economic future will prepare themselves to participate in the free market. This includes making a lifetime commitment to education and training, so they have the skills they need to move up the economic ladder. This commitment and its cost are primarily an individual responsibility. However, government can—and should—play a role in helping to finance education and training programs, providing such programs produce measurable results that lead to individual economic advancement.

Here Is an Economic Policy Argument the Left and Right Should Agree On.

What supply-side economics advocates appreciate more than anyone is that individual incentives matter and that government economic policies should reinforce personal responsibility over dependency. This includes a public-sector commitment to fund educational opportunity and to encourage individuals to develop marketable skills that enable upward income mobility. This may be one policy area where the progressive Left and conservative Right can work together to achieve better outcomes for the middle class and the poor. After all, both should be able to agree on this: If we give someone a fish, we feed them for a day, but if we teach someone how to fish, we feed them for a lifetime. And if we can agree on this, maybe we are all supply-siders.

Eric A. Beck

Editor-In-Chief

Free Nation Media LLC

Greenville, South Carolina

##

Eric Beck

1 Comments

Search Posts

Recent Posts

- My Tribute to a Front-Line Medical Worker Who Set an Example for All of Us. May 31, 2020

- The New York Times Reporting on Coronavirus – The Perfect Example of Anti-Trump Bias. April 29, 2020

- Progressives Believe Tolerance Is an Important Value. Here Is Why They Are Wrong. March 25, 2020

- Six Things I Learned on My Medical Mission Trip to the Dominican Republic. March 5, 2020

- What the Progressive Left Will Not Tell You About Supply-Side Economics: It Works February 5, 2020

more, “pop”! Your content is excellent but with pics and video clips,